Three policy changes will affect Irish property market.

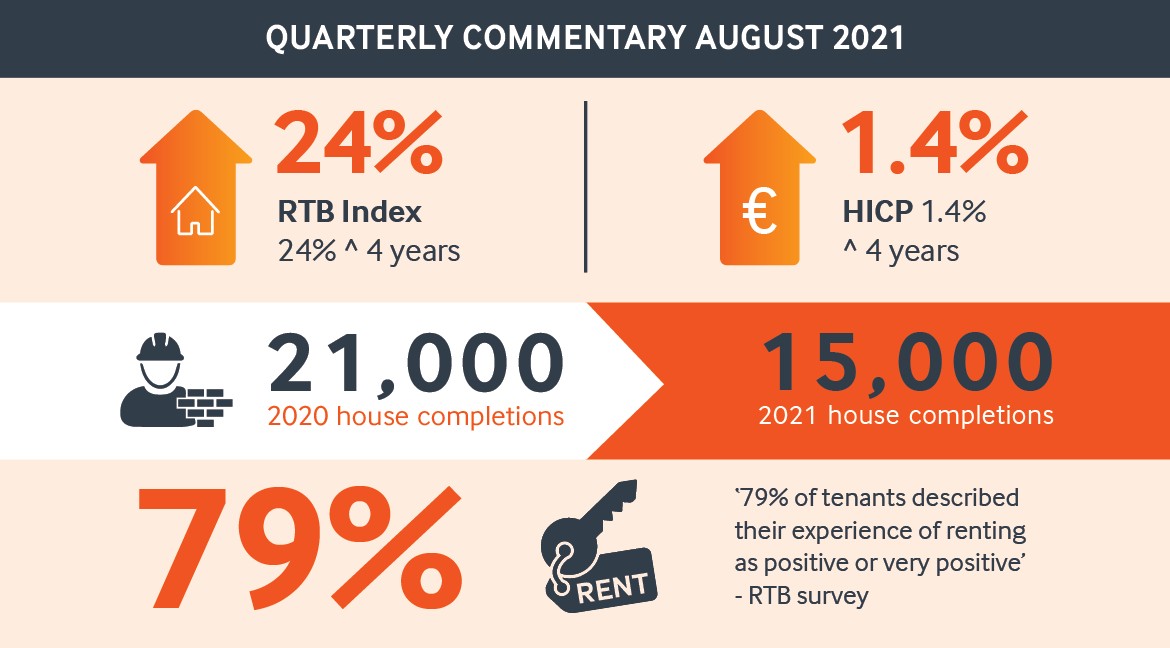

The Pandemic and associated Lockdowns have exacerbated the underlying long-term problem facing the Irish property market- for years now growth in the housing stock has not kept pace with the rise in population. House completions did recover strongly in the second half of last year but the annual total was less than 21,000 and the ESRI expect this year’s figure to be around 15,000, which may be a tad pessimistic but in any event, supply is well short of what most analysts view as the underlying demand for housing. A recipe for rising house prices, and residential property inflation is indeed accelerating, while rents too are picking up, after a soft period last year.

Three policy changes, two announced and one in the pipeline, are likely to impact the market and may well exacerbate the current demand/supply imbalance. Price is a signal, and rising house prices and rents act to dampen demand and incentivise supply, yet the Government has announced that rental increases in the designated Rental Pressure Zones will now be limited to the general rise in consumer prices instead of the previous 4% annual limit. In other words, real rents will be frozen, which will only increase demand for rental property and reduce supply.

The price index chosen, the Harmonised Index of Consumer prices (HICP), is similar to the better-known Consumer Price Index (CPI) and largely covers the same goods and services, albeit with different weights, and so the two tend to move together over time. The HICP measure excludes some items included in the CPI, such as home and motor insurance, as well as the Local Property Tax, but the key difference is that the CPI includes mortgage interest and so the respective inflation measures differ when the ECB is changing its policy rates, falling more rapidly when rates are cut, and outpacing the HICP when the ECB is tightening policy. Half the HICP is made up of goods, and they have generally fallen in price in recent years, due to globalisation, digitalisation and more intense retail competition in Ireland, so it makes little sense to peg the rental price of housing to that standard. For example, the RTB index increased by 24% in the four years to end-2020, against just a 1.4% rise in the HICP. Inflation on the latter measure has picked up this year, to 1.6% on the latest reading, and is forecast by the Irish Government to average around that figure over the next five years, a large cumulative difference, if realised, from the previous 4% limit.

A second policy change, already announced, will also impact the market, albeit perhaps in a less obvious manner; the ECB has raised its inflation target to 2% instead of the cumbersome ‘below but close to 2%’. The Bank has consistently missed the target for years and so the prospects of hitting a higher target are remote, with the implication that interest rates may well stay lower for an even longer period; the market is not priced for a return to positive short term interest rates until mid-2026. Low mortgage rates will therefore continue to bolster demand for housing while lower longer-term rates will increase the attractiveness of Irish rental yields for investment funds.

A final policy change relates to the Central Bank’s mortgage controls, which has yet to be announced but the Bank is signalling that a change may well be in the offing, no doubt influenced by the exodus of two large mortgage lenders allied to the absence of credit growth. Ireland is the only euro country with an LTI limit, 3.5% at present, and the actual average LTI on new loans, at 3.2%, is also very low relative to the European norm, implying a much tighter credit regime here. As it stands 20% of new loans to FTB’s can be above the 3.5 LTI limit, so one option for the Central Bank would be to raise that to say 25%, as opposed to raising the overall 3.5 figure. More likely perhaps, is a move to a debt service metric, which is more common in Europe and takes account of both income and the cost of servicing a mortgage loan. Given the credit backdrop in Ireland it would not be surprising to see a change that results in a boost to loan growth here.